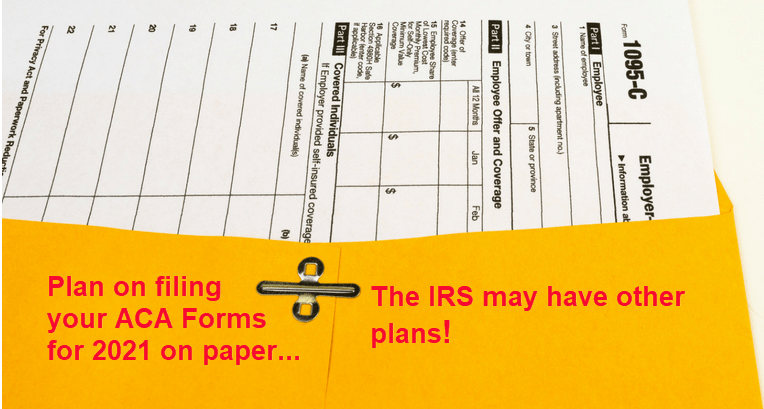

SHRM Posts 5 ACA Reminders As IRS Gets Strict

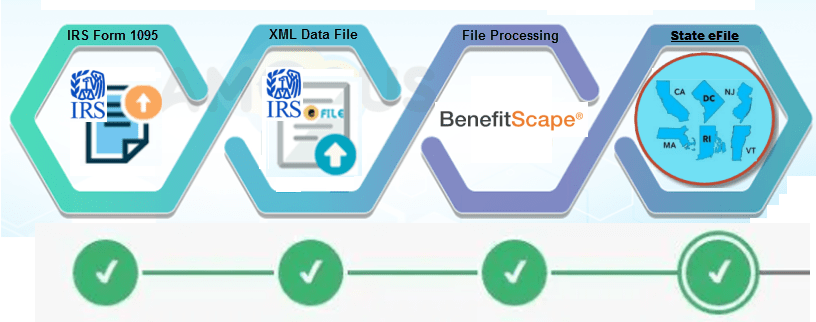

The IRS is ratcheting down on ACA compliance, and employers are seeing more notices and penalties. SHRM [Society for Human Resource Management] posted a useful guide of “the five most helpful reminders” for every ALE [applicable large employer] on rules to remain compliant. If you want all the proven steps to federal and state reporting compliance, […]

SHRM Posts 5 ACA Reminders As IRS Gets Strict Read More »