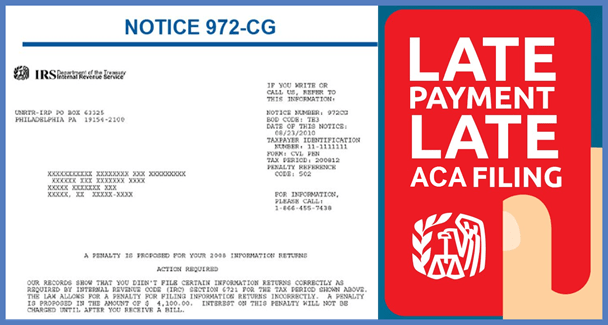

ACA PENALTY UPDATE: IRS ISSUING 972CG NOTICES FOR COLLECTIONS OF LATE FILING OF FORMS 1094/1095 AND TIN VALIDATION ERRORS

The IRS has begun issuing Notice 972CG, a penalty notice regarding late filings of Forms 1094 and 1095 for Tax Year 2017. The notices also include penalties for unresolved TIN validation errors and for not filing returns electronically if you filed more than 250 forms on paper.

It is critical that employers respond to the notice within 45 days of the date of the notice. If you need help in responding to an IRS penalty notice for ACA compliance click here or contact Kim Phillips at 508-655-3307 or email kim.phillips@benefitscape.com.

Penalties are Large, Sometimes $100,000 or More

The late filing penalties range from $50 per form if they were filed within 30 days after the due date of 4/1/2018, $100 per form for those filed more than 30 days late but by 8/1/2018, and $260 per form for those filed after 8/1/2018.

The notices also reference penalties of $260 per form for not electronically filing 1095’s if the employer had more than 250 forms, and for Tax Identification Number (TIN) validation errors of $260 per form. However, The IRS provided transition relief for TIN errors in 2017 if the employer made a good faith effort to comply in providing the correct information.

How to Respond

The first step in responding is to immediately provide notice to the IRS of receipt of the notification and that you are either paying the penalty immediately, or you are contesting the penalty while you are researching to determine your liability.

The IRS has provided guidance on what is deemed a potentially reasonable cause and not willful neglect in late filing cases. These include:

- First time requirement (not First Time Abatement)

- Prior IRS compliance history

- Events beyond the filer’s control, and the filer acted in a responsible manner, and

- Relevant business records were unavailable

As the leader in ACA Compliance Solutions, BenefitScape assists employers in IRS penalty remediation. We have helped hundreds of employers save Millions of dollars in unnecessary IRS penalties. If you have received a penalty notice and need assistance, click here or contact Kim Phillips at 508-655-3307 or email kim.phillips@benefitscape.com.